For instance, kitchen expenses first need to be allocated to the procurement department (a support department). It’s then further allocated to the departments that use the procurement facility. Further, overhead estimation is useful in incorporating seasonal variation and estimate the cost at the start of the project.

Issues With Predetermined Overhead Rates

Also, profits will be affected when sales and production decisions are based on an inaccurate overhead rate. Calculating the Predetermined Overhead Rate (POR) is a critical step in cost accounting, particularly in the manufacturing sector. It involves estimating the manufacturing overhead costs that will be incurred over a specific period and then allocating those costs to the units produced during that period. In simple terms, it’s a kind of allocation rate that is used for estimated costs of manufacturing over a given period. It’s a good way to close your books quickly, since you don’t have to compile actual manufacturing overhead costs when you get to the end of the period. Keep reading to learn about how to find the predetermined overhead rate and what this means.

Income Statement Under Absorption Costing? (All You Need to Know)

The following exercise is designed to help students apply their knowledge of the predetermined overhead rate in a business scenario. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Unexpected expenses can be a result of a big difference between actual and estimated overheads. Overhead rates refer to the allocation of indirect costs to the production of goods or services.

Calculating Overhead Cost Per Unit

Following expense optimization best practices and leveraging technology keeps overhead costs in check. This aids data-driven decision making around overhead rates even for off-site owners and managers. Built-in analytics help uncover spending trends and quickly flag unusual variances for further investigation. Carefully tracking overhead expenses is key for small businesses to optimize costs. This involves categorizing all overhead costs and regularly analyzing them to identify potential savings.

- This critical financial metric is vital for accurately assessing product costs or services.

- Take, for instance, a manufacturing company that produces gadgets; the production process of the gadgets would require raw material inputs and direct labor.

- This will help you price your services correctly and increase your profits.

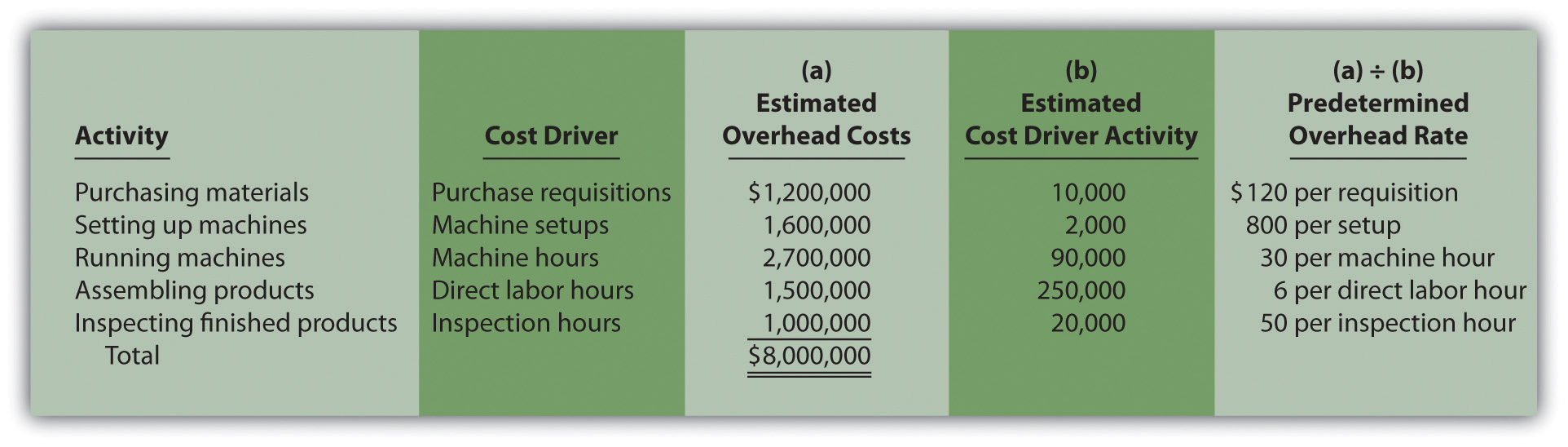

Hence, one of the major advantages of predetermined overhead rate formula is that it is useful in price setting. Therefore, in simple terms, the POHR formula can be said to be a metric for an estimated rate of the cost of manufacturing a product over a specific period of time. That is, a predetermined overhead rate includes the ratio of the estimated overhead costs for the year to the estimated level of activity for the year.

Concerns Surrounding Predetermined Overhead Rates

Knowing the total and component costs of the product is necessary for price setting and for measuring the efficiency and effectiveness of the organization. Remember that product costs consist of direct materials, direct labor, and manufacturing overhead. Now management can estimate how much overhead will be required for upcoming work or even competitive bids. For instance, assume the company is bidding on a job that will most likely take $5,000 of labor costs.

Her expertise lies in marketing, economics, finance, biology, and literature. She enjoys writing in these fields to educate and share her wealth of knowledge and experience. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

The use of predetermined overheads effectively incorporates the cost effects of seasonal variations in the product cost and price. Let’s understand the steps in calculating the predetermined overhead rate. It’s also important to note that budgeted figures in calculating overhead rates are used about form 1094 due to seasonal fluctuation/expected changes in the external environment. As a result, there is a high probability that the actual overheads incurred could turn out to be way different than the estimate. Carefully minimizing overhead is crucial for small businesses to maintain profitability.

The management can estimate its overhead costs to be $7,500 and include them in the total bid price. The predetermined rate is also used for preparing budgets and estimating jobs costs for future projects. In larger companies, each department in which different production processes take place usually computes its own predetermined overhead rate. The formula for a predetermined overhead rate is expressed as a ratio of the estimated amount of manufacturing overhead to be incurred in a period to the estimated activity base for the period. Take, for instance, a manufacturing company that produces gadgets; the production process of the gadgets would require raw material inputs and direct labor. These two factors would definitely make up part of the cost of producing each gadget.