It is the inventory level that company place order and receive material without disturbing the production process. It also helps to minimize the storage cost which incurs when company stores inventory more than it needs. Since the company follows LIFO Method, 1 million units will be priced at the latest inventory. As the months proceed, there is a sudden increase in the demand for the product. At the end of year 3, the company had 1.5 million units in its inventory stock.

How Does It Impact Net Income?

In total, the cost of the widgets under the LIFO method is $1,200, or five at $200 and two at $100. As we use LIFO, the cost of goods sold will depend on latest price which we bought from the supplier. As we use LIFO, the cost of goods sold will exceed the latest price which we bought from the supplier. The cost of 2,000 units sold will base on the current price and another 1,000 units base on the previous price.

Please Sign in to set this content as a favorite.

Some companies may provide discounts on the old stock to increase sales. In terms of accounting, the older stockpiles in the company’s inventory are often called layers. Since the company buys new inventory in every financial period, the old inventory stacks up. Following LIFO liquidation may be tempting to distort the financial statements and evade taxes compared to FIFO inventory; however, it is not treated as the best practice bylaws.

- The lower cost of older inventory is offset by the high cost of another item in combination.

- This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

- In other words, under the LIFO method, the cost of the most recent lot of materials purchased is charged until the lot is exhausted.

What Is LIFO Reserve?

LIFO is banned under the International Financial Reporting Standards that are used by most of the world because it minimizes taxable income. That only occurs when inflation is a factor, but governments still don’t like it. In addition, there is the risk that the earnings of a company that is being liquidated can be artificially inflated by the use of LIFO accounting in previous years. Most companies that use LIFO inventory valuations need to maintain large inventories, such as retailers and auto dealerships.

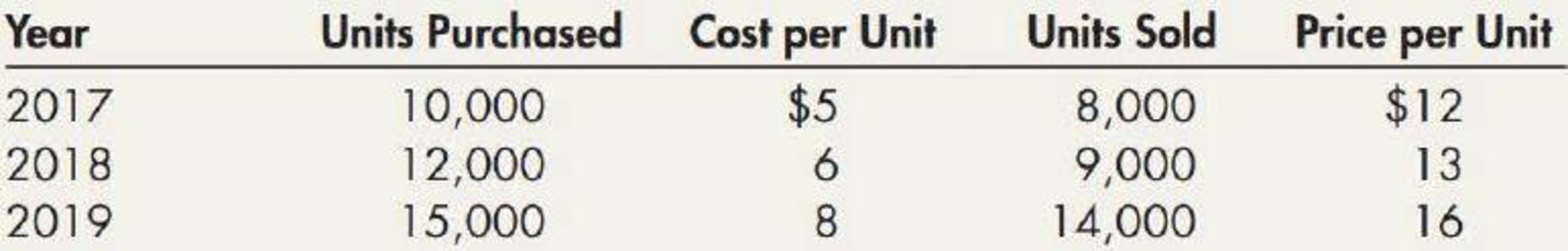

Macrons & Macrons is a consumer product company and uses the LIFO method of inventory valuation. LIFO liquidation causes distortion of net operating income and may become a reason of a higher tax bill in current period. When LIFO inventory is liquidated, the old costs are matched with the current revenues and as a result, financial statements show higher income. The LIFO liquidation, therefore, causes a higher tax liability in periods of high inflation. ABC Company uses the LIFO method of inventory accounting for its domestic stores.

An election under this section shall be irrevocable and shall be binding for the liquidation year and for all determinations for prior and subsequent taxable years insofar as such determinations are affected by the adjustments under this section. Critics of LIFO often claim that it misrepresents the cost of goods sold because most companies try to sell old inventory before new inventory, like in the case of milk at a grocery store. It is important to review disclosures on LIFO reserves to determine if LIFO liquidation has occurred.

In other words, it occurs when a company using LIFO method sells (or issues) more inventory than it purchases. LIFO liquidation is an event of selling old inventory stock by companies that follow the LIFO Inventory Costing Method. During such liquidation, the stocks valued at older costs are matched with the latest revenue after-sales, due to which the company reports higher net income, which results in payment of higher taxes. The LIFO reserve comes about because most businesses use the FIFO, or standard cost method, for internal use and the LIFO method for external reporting, as is the case with tax preparation. This is advantageous in periods of rising prices because it reduces a company’s tax burden when it reports using the LIFO method.

(B) the period specified by the Secretary in a notice published in the Federal Register with respect to that qualified inventory interruption. The term “qualified inventory interruption” means a regulation, request, or interruption described in subparagraph (B) but only to the extent provided in the notice published pursuant to subparagraph (B). (B) the taxpayer establishes to the satisfaction of the Secretary that such decrease is directly and primarily attributable to a qualified inventory interruption. Then the gross income of the taxpayer for such taxable year shall be adjusted as provided in subsection (b). Because LIFO often does not accurately represent the flow of inventory, companies in the U.S. are required to present an acceptable conversion of inventory accounting, such as first in, first out (or FIFO). The goal of any inventory accounting method is to represent the physical flow of inventory.

However, there are certain scenarios, economic conditions, and implications that a company has to delayer its older stock or inventory. The original statutory scheme recognizes that each estate is different and allows the superintendent to bring the appropriate expertise to bear on each individual circumstance. Unfortunately, figuring out how many allowances you can claim on w the Liquidation Bureau by its very nature (a fixed staff of 500 people, most of who are protected by a union contract) is a one-size-fits-all operation with a voracious appetite but little flexibility. The result is a statutory process that has been high-jacked by a non-statutory entity accountable to no one.