Usually, the most common type of this source includes common stock, also known as ordinary stock. Some companies may also have other options when raising finance from this source. Usually, this involves preferred stock, which differs from common stock. Accounting for stock transactions can be complicated, but it’s also necessary to keep a firm grip on your company’s finances. Knowing the impact of issuing stock to raise cash or other capital is vital to make sure you make the best financial decisions for your business.

Examples With Journal Entries

For example, on July 1, we issue 1,000 shares of common stock at the value of $15 per share. It is useful to note that in many jurisdictions, issuing the common stock below par value is not allowed and is considered illegal. Additionally, even though some jurisdictions allow the issuance of the common stock below its par value, such activity is usually very rare. In this case, we will record the land in the balance sheet as $50,000 ($10,000 x 5,000 shares) even though the land was put on sale for a different price (e.i. $60,000). This is due to the due to the share price on the capital market is considered to be more reliable than the asking price of the land.

Income Statement Under Absorption Costing? (All You Need to Know)

Corporations often set this figure so high that they never have to worry about reaching it. However, states do allow the authorization to be raised if necessary. Some of these terms have been examined previously, others have not.

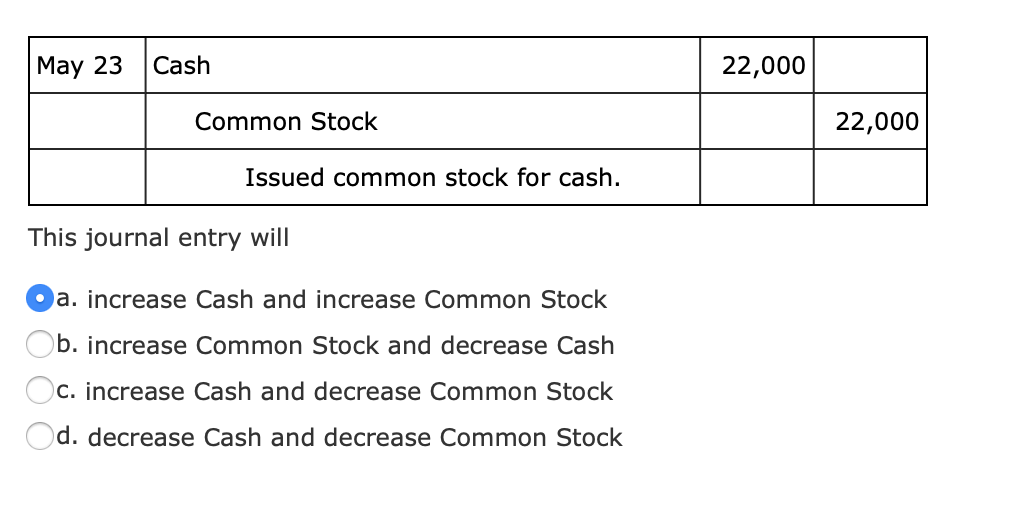

Example of issuing common stock for cash

And the Bank account, being the return of the monies that were not allotted. At this point, we typically try and provide a quick answer to the question we are addressing. But this time, I’m afraid there isn’t a quick few words or a single journal entry to mention here. But please scroll down to the example that matches the problem you are dealing with; we should have them all covered. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Issuing No-Par Value Stock

We then have two credit entries, the first being $100,000 to theClass A Share Capital, which records the par value of the shares exchanged. And then the $1,400,000, which records the addition paid-in capital, or the share premium Kevin paid. In this journal entry, the total expenses on the income statement and the total equity on the balance sheet increase by the same amount. The expense amount in this journal entry is the fair value of the service that the corporation receives in exchange for giving up the shares of the common stock. In addition to the non-cash asset, we may also issue the common stock in exchange for the service instead.

Reporting Treasury Stock for Nestlé Holdings Group

- These investors then become shareholders, and their ownership stake in the company is based on the percentage of shares they hold.

- They will receive cash as the number of shares are sold to the investor.

- This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

- 2Many other laws have been passed over the years that have been much more effective at protecting both creditors and stockholders.

- However, other sources of finance or equity do not have the same effect.

Investors simply purchase the stock from the issuer and gain ownership over the company’s share. Keep in mind your journal entry must always balance (total debits must equal total credits). Watch this video to demonstrate par and no-par value transactions. Notice how the accounting is the same for common and preferred stock. We have a debit to the fixed assets account, with an increase of $1,500,000.

Issued Shares are the number of shares that company sells to investors. They are the authorized shares that sold to the investors in the market. They will receive cash as the number of shares are sold to the investor. Moreover, the company may issue a share to acquire another company by giving the business owner share equity. Company P issue 10,000 shares of its $ 1 par value common stock in exchange for the building. The building has a book value of $ 1.3 million but the owner claims that the fair value of the building is $ 1.5 million which base on the internal evaluation team.

Overall, accounting for the issuance of a common stock involves the separation of the compensation received. As mentioned, this process includes calculating the par value of the underlying shares issued. Any excess amount received ends up on the share premium account. This total reflects the assets conveyed to the business in exchange for capital stock.

In most cases, the stock market value is more reliable as they trade in the capital market with many buyers and sellers. Unless the stock market value is not available, then asset fair value will be use. No par value stock is the share that issue to the market without stating its par value on the certificate.

There are a few things which you should be known related to common share. First, selling price is the amount that investors have to pay to receive the share. Second, the par value is the value stated on the share certificate. This value is usually set what is manufacturing overhead and what does it include at a minimum, allowing the company to manage and issue new share in the future. Capital is the money that a business uses to support its operations and growth. In some cases, capital also refers to human resources, Machinery, building, and land.